Deciding between a Gold IRA and physical gold can appear like a challenging dilemma. Each offer strengths, but their strategies differ noticeably. A Gold IRA is a retirement plan that allows you to contribute in gold bars, offering tax advantages. Conversely, physical gold represents real gold that you possess, providing a perception of control.

- Think about your financial goals and tolerance.

- Explore the fees associated with both options.

- Talk to a financial advisor to identify the best method for your needs.

Gold IRA vs. 401(k): A Retirement Investment Showdown

Are you planning for retirement and searching about the best investment options? Two popular choices often come up: the Gold IRA and the traditional 401(k). Both offer advantages, but understanding their key distinctions is crucial before making a decision. A Gold IRA allows you to invest in physical gold, potentially providing protection against inflation and market volatility. On the other hand, a 401(k) is a retirement plan offered by employers, often with employer matching contributions, which can significantly boost your savings.

- Analyzing factors like risk tolerance, investment goals, and tax implications will help you determine the best fit for your unique retirement circumstances.

- This article delves into the pluses and cons of each option to empower you to make an informed decision.

Benefits and Drawbacks of a Gold IRA: Weighing the Perks and Dangers

A Gold Individual Retirement Account (IRA) can be an intriguing alternative for investors seeking to allocate their retirement portfolio. Nevertheless, it's essential to carefully consider both the benefits and negative before committing on this path.

- A key merit of a Gold IRA is its ability to mitigate against inflation. Gold has historically conserved its value during periods of economic uncertainty.

- Conversely, Gold IRAs can be significantly complicated to manage compared to traditional brokerage accounts. Moreover, there are annual fees connected with maintaining gold in an IRA.

- Prior to a Gold IRA, it's crucial to speak with a experienced financial consultant. They can guide you in determining whether a Gold IRA is suitable with your overall financial goals and risk tolerance.

Best Gold IRAs: Find the Ideal Account for Your Portfolio

Investing in precious metals like gold can be a wise move to diversify your portfolio and hedge against market volatility. A Gold IRA allows you to hold physical gold within a tax-advantaged retirement account. However, with numerous providers available, finding the best Gold IRA can be complex.

This article will guide you in navigating the realm of Gold IRAs, pointing out key factors to consider and suggesting some of the most popular choices on the market. By thoroughly evaluating your requirements, you can select a Gold IRA that aligns your investment goals.

- Assess the fees associated with each Gold IRA provider.

- Investigate the track record of the company and read customer comments.

- Contrast the varieties of gold products offered, such as bars and coins.

Keep in mind a Gold IRA can be a valuable addition to your overall retirement plan, but it's essential to conduct your due diligence before making a commitment.

Harnessing Tax Advantages with a Gold IRA: A Comprehensive Guide

A Gold IRA offers a unique avenue to safeguard your retirement savings from the volatility of the traditional market. By investing in physical gold, you can potentially Gold IRA vs physical gold mitigate your tax burden. This comprehensive guide will illuminate the intricacies of Gold IRAs and empower you to make informed decisions about your financial future.

- Discover the tax benefits associated with Gold IRA contributions.

- Understand the different types of gold eligible for IRA investment.

- Gain insights about choosing a reputable custodian for your Gold IRA.

Don't neglect this crucial opportunity to enhance your retirement savings with the prudence of a Gold IRA.

Investing in Precious Metals: The Ultimate Gold IRA Comparison

Embarking on a voyage to secure your financial tomorrow often involves considering various investment options. Among these, precious metals, particularly gold, have long been viewed as a reliable hedge against inflation and economic turmoil. A Gold IRA, or Individual Retirement Account, provides a distinct avenue for allocating your retirement funds in these valuable assets. However, navigating the world of Gold IRAs can seem overwhelming. With numerous providers vying for your business, it's essential to conduct a thorough comparison to guarantee you're making an informed decision that aligns with your financial goals.

- Firstly, it's crucial to assess the experience of potential Gold IRA providers. Look for companies with a proven reputation, legal adherence, and a background of client satisfaction.

- Moreover, examine the charges associated with each provider. These can include account fees, buying/selling fees, and storage fees. Opting for a provider with transparent and fair fees can substantially impact your overall returns.

- Lastly, evaluate the selection options offered by each Gold IRA provider. A wide range of gold products, such as bars, can provide options to tailor your portfolio to your return tolerance and financial goals.

Barry Watson Then & Now!

Barry Watson Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Freddie Prinze Jr. Then & Now!

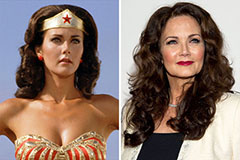

Freddie Prinze Jr. Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!